2023-24 Update: Australian Tax, Financial Reporting and Legislation

This course covers key developments across tax, superannuation, financial reporting, anti-money laundering and more, It will ensure you give your clients the latest advice on the issues important to them.

This course is not currently available

This course will enable you to

- Advise on the key changes to individual and business taxes for 2023-24.

- Get up to date with recent and upcoming superannuation changes, including revisions to superannuation concessions.

- Discuss key IFRS and AASB financial reporting updates.

- Understand the proposed changes to anti-money laundering legislation and their impact on accountants.

About the course

Stay ahead of the curve with the latest updates in tax, superannuation, and financial reporting. Make sure you remain compliant and avoid costly penalties.

This course looks at important accounting updates for you to get to grips with in 2023-24, from small business incentives, superannuation limits, new sustainability standards and more. You will evaluate key developments, equipping you to offer your clients up-to-date advice on matters that impact them the most. Additionally, we’ll explore impending changes in anti-money laundering (AML) legislation, preparing you for potential compliance challenges.

Look inside

Contents

- Tax

- Individuals

- Businesses: temporary measures

- Businesses: new measures

- Further updates

- Spotlight on the ATO

- Superannuation

- Key super rates and thresholds

- ATO spotlight on super

- Legislating the objective of superannuation

- Superannuation concessions limits

- "Payday" superannuation

- Non-arm's length income

- Amendments to the Fair Work Act

- Financial reporting

- IFRS standard-setting process

- Australian standard-setting process

- IFRS 10, 11 and 12

- Sustainability standards

- Business combinations

- IFRS for SMEs

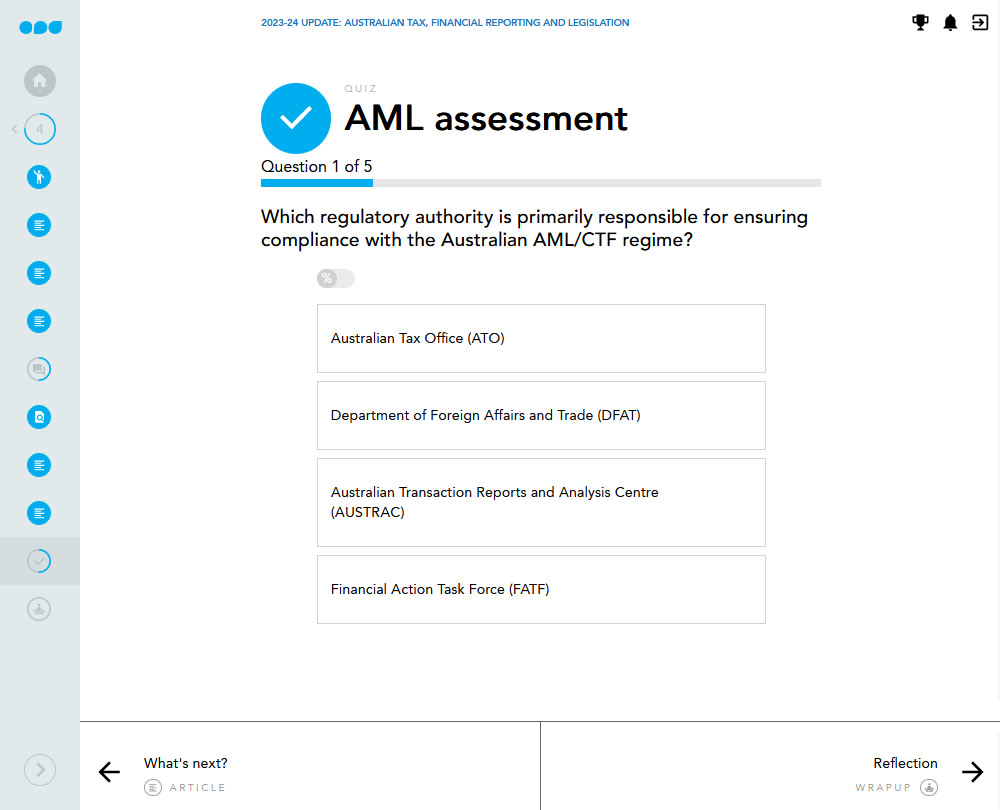

- AML/CTF legislation

- Australia's AML/CTF regime

- Proposed changes

- Obligations for accountants

- Getting ready

- What's next?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.