Self Assessment Tips for Accountants

This course has been reviewed and is up to date for the tax year 2017-18. Your clients expect you to know how to deal with every situation. But they are all different. Broaden your experience of self assessment by working through our scenarios and identifying the correct advice. Along the way, pick up advice and tips on how to avoid the pitfalls from our team of experts from Gabelle.

This course will enable you to

- Discuss with your clients the nuances in tax

- Understand the factors that should be taken into account to ensure income and gains are correctly disclosed and all relevant claims made

- Consider some of the more complicated areas of self assessment in relation to the reporting of income and gains

- Recognise issues around the administrative process when completing self assessment returns

About the course

Self assessment returns are the key way in which a taxpayer's financial affairs are communicated to HMRC. Your clients expect you to know how to deal with every situation. But they are all different. So, in order to give your clients the best possible support with their returns it will be important to understand some of the more complicated areas of self assessment. Broaden your experience of self assessment by working through our scenarios and identifying the correct advice. Along the way, pick up advice and tips on how to avoid the pitfalls from our team of experts from Gabelle.

The Tax Tips for Accountants series is a unique collection of CPD courses designed to give accountants what they need to know about tax, to help their organisation and their clients. Instead of having to wade through a mire of technical tax detail, these courses let you work through scenarios and decide what advice to give, picking up tips as you go on how to avoid the pitfalls. The series has been designed by tax specialists, Gabelle, and is based on the most frequently asked questions on their accountants' helpline.

Look inside

Contents

- Claims

- Entrepreneurs' relief and making a claim

- Valid EIS claims

- Loan notes and making the election

- Charitable donations

- Excess capital allowances

- Taxation of foreign dividends

- Claiming non-residence

- Claiming the remittance basis

- Income and Gains

- Termination payments and the £30,000 exemption

- Employee shares

- Partnership drawings

- Other Admin

- Partnership disputes

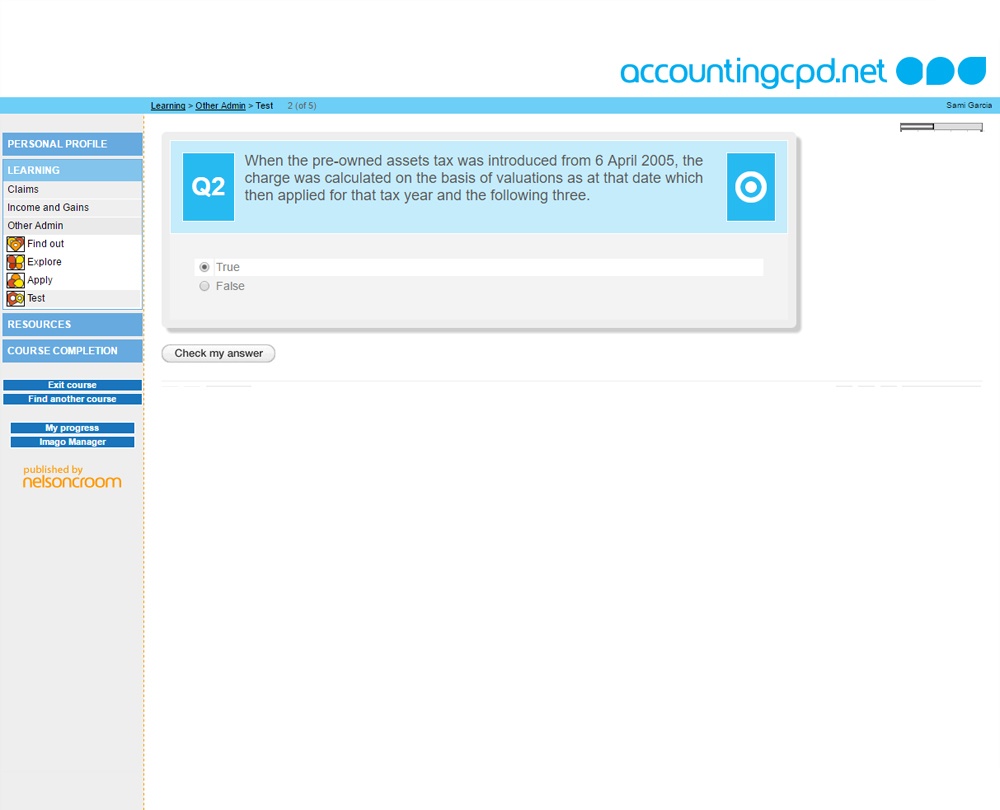

- Pre-owned assets

- Nominated income

- Penalties

How it works

Reviews

You might also like

Take a look at some of our bestselling courses