2024-25 Update: UK and Irish GAAP

Following the publication of FRED 82, the FRC has now confirmed the final changes being made to the UK and Ireland GAAP. This course provides a well-timed review of areas in the spotlight, particularly focusing on leasing transactions and revenue recognition.

This course will enable you to

- Advise on the latest proposed amendments to UK and Ireland GAAP

- Improve your knowledge of the rules regarding going concern

- Understand how cash flow statements should be prepared and avoid common errors

- Learn how to recognise intangible assets

About the course

Following the publication of FRED 82, the FRC has now confirmed the final changes being made to the UK and Ireland GAAP. This course provides a well-timed review of areas in the spotlight, including leasing transactions, where the FRC proposes that lessees are to be reported on-balance sheet and is considering further simplifications, and revenue recognition where the changes proposed incorporate a five-step model approach and redrafted sections for both FRS 102 and FRS 105.

This course also explores the rules on going concern and the importance of disclosures, cash flow - how business activities should be treated and the measurement of net debt, and the ins and outs of intangible assets, including initial recognition, measurement, and the relevance of amortisation. It also covers classifying R&D expenditure and evaluating goodwill.

Look inside

Contents

- General update

- The updates

- Current status of the periodic review

- Lease accounting and revenue recognition

- On-balance sheet lease accounting

- Revenue recognition

- Small entities in the UK

- Going concern

- Who assesses and audits going concern?

- Going concern - bases for preparing financial statements

- Going concern assessments

- Disclosures and their impact

- Disclosing material uncertainties

- Cash flow statements

- Cash flow classifications

- Getting classifications right

- Indirect and direct methods

- Reconciliation of net debt

- Cash flow statement common errors

- Mistakes to watch out for

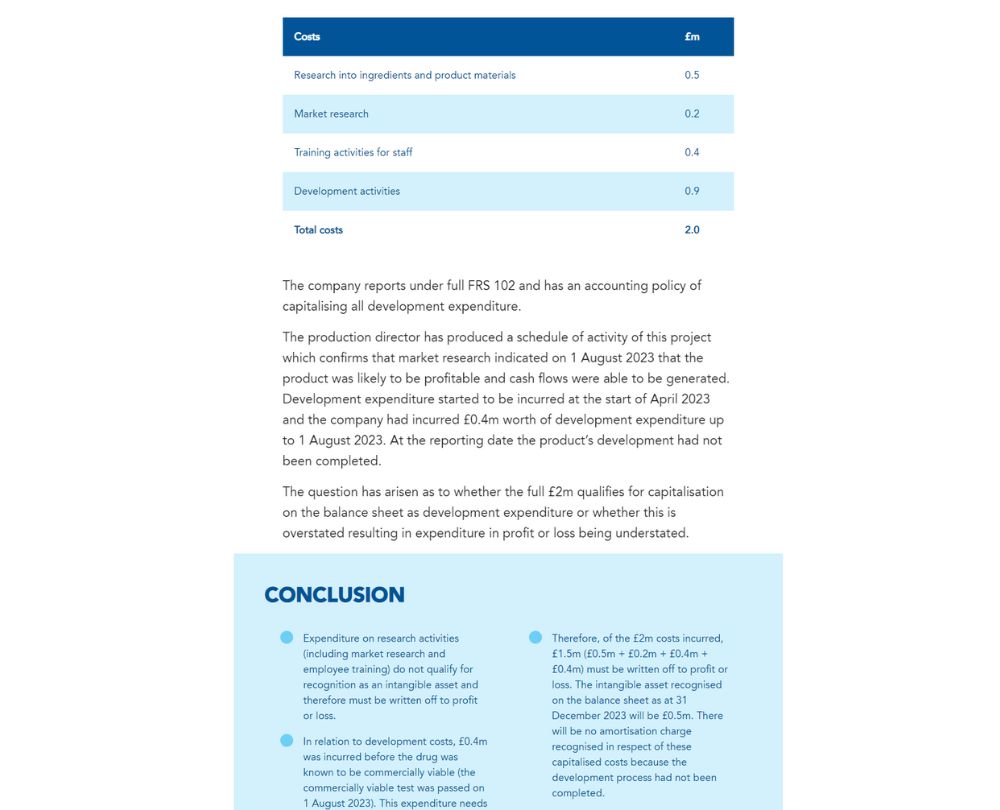

- Intangible assets

- Recognition of intangible assets

- Measurement

- Amortisation

- Amortisation of intangible assets

- Research and development costs

- Goodwill

- The recognition of goodwill

How it works

Reviews

You might also like

Take a look at some of our bestselling courses